更多“Calculate the duration of a tw…”相关的问题

更多“Calculate the duration of a tw…”相关的问题

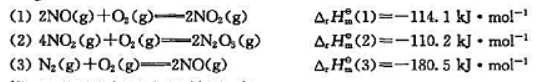

Calculate the standard molar enthalpy of formation for N2O5(g) from the

following date:

(c) Assuming that Joanne registers for value added tax (VAT) with effect from 1 April 2006:

(i) Calculate her income tax (IT) and capital gains tax (CGT) payable for the year of assessment 2005/06.

You are not required to calculate any national insurance liabilities in this sub-part. (6 marks)

Simon then renovated the house at a cost of £50,600, with the renovation being completed on 10 August 2008. He immediately put the house up for sale, and it was sold on 31 August 2008 for £260,000. Legal fees of £2,600 were paid in respect of the sale.

Simon fi nanced the transaction by a bank loan of £150,000 that was taken out on 1 May 2008 at an annual interest rate of 6%. The bank loan was repaid on 31 August 2008.

Simon had no other income or capital gains for the tax year 2008–09 except as indicated above.

Simon has been advised that whether or not he is treated as carrying on a trade will be determined according to the six following ‘badges of trade’:

(1) Subject matter of the transaction.

(2) Length of ownership.

(3) Frequency of similar transactions.

(4) Work done on the property.

(5) Circumstances responsible for the realisation.

(6) Motive.

Required:

(a) Briefl y explain the meaning of each of the six ‘badges of trade’ listed in the question.

Note: You are not expected to quote from decided cases. (3 marks)

(b) Calculate Simon House’s income tax liability and his Class 2 and Class 4 national insurance contributions for the tax year 2008–09, if he is treated as carrying on a trade in respect of the disposal of the freehold house.(8 marks)

(c) Calculate Simon House’s capital gains tax liability for the tax year 2008–09, if he is not treated as carrying on a trade in respect of the disposal of the freehold house. (4 marks)

The McIntyre Resort (MR), which is privately owned, is a world famous luxury hotel and golf complex. It has been chosen as the venue to stage ‘The Robyn Cup’, a golf tournament which is contested by teams of golfers from across the globe, which is scheduled to take place during July 2009. MR will offer accommodation for each of the five nights on which guests would require accommodation.

The following information is available regarding the period of the tournament:

(1) Hotel data:

Total rooms 2,400

Room mix:

Double rooms 75%

Single rooms 15%

Family rooms 10%

Fee per room per night ($):

Double rooms 400

Single rooms 300

Family rooms 600

Number of guests per room:

Double rooms 2

Single rooms 1

Family rooms 4

When occupied, all rooms will contain the number of guests as above.

Costs:

Variable cost per guest per night $100

Attributable fixed costs for the five-day period:

Double rooms $516,000

Single and family rooms (total) $300,000

(2) Accommodation for guests is provided on an all-inclusive basis (meals, drinks, entertainment etc).

(3) The objective of the hotel management is to maximise profit.

(4) The hotel management expect all single and family rooms to be ‘sold out’ for each of the five nights of the

tournament. However, they are unsure whether the fee in respect of double rooms should be increased or

decreased. At a price of $400 per room per night they expect an occupancy rate of 80% of available double

rooms. For each $10 increase/decrease they expect the number of rooms to decrease/increase by 40.

Required:

(a) (i) Calculate the profit-maximising fee per double room that MR should charge per night during the

tournament; (6 marks)

(ii) Calculate how much profit would be earned from staging the tournament as a consequence of charging

that fee. (4 marks)

(b) The management of the hotel are concerned by the level of variable costs per guest night to be incurred in respect of the tournament. A recent review of proposed operational activities has concluded that variable cost per guest per night in all rooms in the hotel would be reduced by 20% if proposed changes in operational activities were made. However, this would result in additional attributable fixed costs amounting to $200,000 in respect of the five day period.

Required:

Advise management whether, on purely financial grounds, they should make the proposed changes in

operational activities. (6 marks)

(c) Discuss TWO initiatives that management might consider in order to further improve the profit from staging the golf tournament. (4 marks)

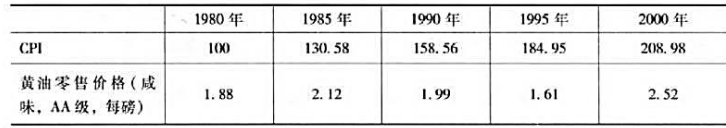

下表所显示的是1980-2000年间黄油的平均零售价格和消费者价格指数,1980年CPI=100。

(1)计算以1980年美元衡量的黄油实际价格,从1980-2000年,实际价格是上升了,还是下降了,抑或没有变化?

(2)从1980-2000年间,黄油实际价格(1980年美元)的变化率是多少?

(3)把CPI指数转换成1990=100的指数,然后以1990年美元来确定黄油的实际价格。

(4)从1980- 2000年间,黄油实际价格(1990年美元)的变化率是多少?试和你在(2)所得出的答案进行比较,你注意到什么了吗?请给出解释。

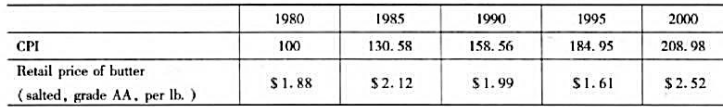

The following table shows the average retail price of butter and the Consumer Price Index from 1980 to 2000, scaled so that the CPI=100 in 1980.

a. Calculate the real price of butter in 1980 dollars. Has the real price increased/ decreased/stayed the same since 1980?

b. What is the percentage change in the real price (1980 dollars) from 1980 to 2000?

c. Convert the CPI into 1990 = 100 and determine the real price of butter in 1990 dollars.

d. What is the percentage change in the real price (1990 dollars) from 1980 to 2000? Compare this with your answer in (b). What do you notice? Explain.

此题为判断题(对,错)。

Improvement in reading efficiency has several major benefits. We need reading skills to benefit from the wealth of information that is now available in printed form. Most people get the rough outlines of their daily news from television and radio. However, the printed word still provides the in-depth coverage of topics that really produces well-informed people. Reading is also a great source of entertainment for many people. For students, it is the primary method of studying.

The time you now spend reading can be made much more productive by increasing your reading rate. For some people this will mean that they can obtain more information in the same length of time. For others it will mean that time now devoted to reading can be used in other more interesting and profitable ways.

To determine how fast you are reading, you first have to get some idea of the number of words in a given passage. Then you simply divide the number of words by the number of minutes it takes to read. That will give your rate in words per minute.

1、The passage is taken from.()

A、a story book

B、a news report

C、a report on a scientific research

D、a book on reading

2、Which of the following statements is NOT a benefit from reading according to the passage?()

A、Reading will help readers get more information

B、By reading readers will have an in-depth coverage of daily news

C、Students must read so that they can master knowledge

D、Improvement of reading helps readers get outlines of daily news

3、This passage mainly discusses.()

A、different kinds of reading

B、the importance of improving reading skills and how to calculate reading rate

C、reading as a source of entertainment

D、different ways to improve reading speed

4、"reading efficiency" in Paragraph 2 means.()

A、the average reading rate

B、the ability of reading fast with a good understanding

C、reading materials readers like

D、reading habits

5、Reading speed can be calculated by.()

A、counting how many words a reader has read

B、dividing the total number of words a reader read by the time he spends on reading

C、timing how many minutes a reader has read

D、asking help from the teacher

Domingo Gomez

(1) Domingo is aged 67.

(2) During the tax year 2008-09 he received the state pension of £4,500 and a private pension of £2,300.

(3) In addition to his pension income Domingo received building society interest of £14,400 and interest of £600 on the maturity of a savings certificate from the National Savings and Investments Bank during the tax year 2008–09. These were the actual cash amounts received.

(4) During the tax year 2008–09 Domingo made donations of £300 (gross) to local charities. These were not made under the gift aid scheme.

Erigo Gomez

(1) Erigo is aged 56.

(2) He is employed as a business journalist by Economical plc, a magazine publishing company. During the tax year 2008–09 Erigo was paid a gross annual salary of £36,000.

(3) During the tax year 2008–09 Erigo used his private motor car for business purposes. He drove 18,000 miles in the performance of his duties for Economical plc, for which the company paid an allowance of 20 pence per mile.

(4) During June 2008 Economical plc paid £11,400 towards the cost of Erigo’s relocation when he was required to move his place of employment. Erigo’s previous main residence was 140 miles from his new place of employment with the company. The £11,400 covered the cost of disposing of Erigo’s old property and of acquiring a new property.

(5) Erigo contributed 6% of his gross salary of £36,000 into Economical plc’s HM Revenue and Customs’ registered occupational pension scheme.

(6) During the tax year 2008–09 Erigo donated £100 (gross) per month to charity under the payroll deduction scheme.

Fargo Gomez

(1) Fargo is aged 53.

(2) He commenced self-employment as a business consultant on 6 July 2008. Fargo’s tax adjusted trading profit based on his draft accounts for the nine-month period ended 5 April 2009 is £64,800. This figure is before making any adjustments required for:

(i) Advertising expenditure of £2,600 incurred during May 2008. This expenditure has not been deducted in

calculating the profit of £64,800.

(ii) Capital allowances.

(3) The only item of plant and machinery owned by Fargo is his motor car. This cost £11,000 on 6 July 2008.

During the nine-month period ended 5 April 2009 Fargo drove a total of 24,000 miles, of which 8,000 were for private journeys.

(4) During the tax year 2008-09 Fargo contributed £5,200 (gross) into a personal pension scheme, and made gift aid donations totalling £2,400 (net) to national charities.

Tax returns

For the tax year 2008–09 Domingo wants to file a paper self-assessment tax return and have HM Revenue and Customs prepare a self-assessment on his behalf. Erigo also wants to file a paper tax return but will prepare his own self-assessment. Fargo wants to file his tax return online.

Required:

(a) Calculate the respective income tax liabilities for the tax year 2008–09 of:

(i) Domingo Gomez; (6 marks)

(ii) Erigo Gomez; (6 marks)

(iii) Fargo Gomez. (7 marks)

(b) Advise Domingo, Erigo and Fargo Gomez of the latest dates by which their respective self-assessment tax returns for the tax year 2008–09 will have to be submitted given their stated filing preferences. (3 marks)

(c) Advise Domingo, Erigo and Fargo Gomez as to how long they must retain the records used in preparing their respective tax returns for the tax year 2008–09, and the potential consequences of not retaining the records for the required period. (3 marks)