更多“What was the price of US dolla…”相关的问题

更多“What was the price of US dolla…”相关的问题

A.Looking like a bear.

B.Taking an attitude of a bear.

C.Thinking the price would drop.

D.Making sth. as a bear.

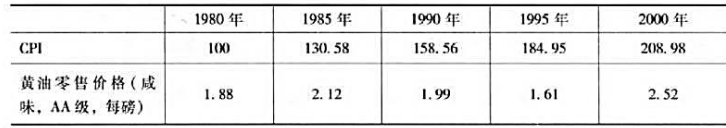

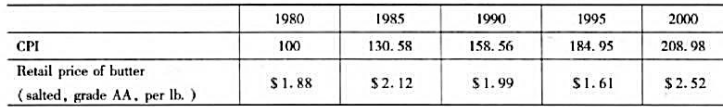

下表所显示的是1980-2000年间黄油的平均零售价格和消费者价格指数,1980年CPI=100。

(1)计算以1980年美元衡量的黄油实际价格,从1980-2000年,实际价格是上升了,还是下降了,抑或没有变化?

(2)从1980-2000年间,黄油实际价格(1980年美元)的变化率是多少?

(3)把CPI指数转换成1990=100的指数,然后以1990年美元来确定黄油的实际价格。

(4)从1980- 2000年间,黄油实际价格(1990年美元)的变化率是多少?试和你在(2)所得出的答案进行比较,你注意到什么了吗?请给出解释。

The following table shows the average retail price of butter and the Consumer Price Index from 1980 to 2000, scaled so that the CPI=100 in 1980.

a. Calculate the real price of butter in 1980 dollars. Has the real price increased/ decreased/stayed the same since 1980?

b. What is the percentage change in the real price (1980 dollars) from 1980 to 2000?

c. Convert the CPI into 1990 = 100 and determine the real price of butter in 1990 dollars.

d. What is the percentage change in the real price (1990 dollars) from 1980 to 2000? Compare this with your answer in (b). What do you notice? Explain.

此题为判断题(对,错)。

听力原文:M: Would you tell me about the main contents of the document?

W: Name, quality, unit price and amount of goods, ports of loading and destination, price and payment terms, shipping documents, latest shipment date and validity of the L/C.

Q: What may be the name of the document?

(19)

A.Collection Order.

B.Bill of Lading.

C.Letter of Credit.

D.Certificate of Origin.

A.Purchase orders for consumable materials with account assignment details

B.Purchase requisitions with multiple account assignment categories

C.Purchase requisitions for consumable materials without account assignment details

D.Purchase orders without valuation price

(1)国内价格将是多少?

(2)国内生产者和消费者的损益各为多少?

(3)对无谓损失和国外生产者会产生什么影响?

Example 9.5 (page 308 ) describes the effects of the sugar quota. In 2005 , imports were limited to 5.3 billion pounds , which pushed the domestic price to 27 cents per pound. Suppose imports were expanded to 10 billion pounds.

a What would be the new U. S. domestic price?

b. How much would consumers gain and domestic producers lose?

c. What would be the effect on deadweight loss and foreign producers?

听力原文: Currency options may have two kinds of value, intrinsic value and time value. If and to the extent that an option would currently be profitable to exercise, it is said to have intrinsic value. In the case of a call, if the spot price is higher than the option exercise price, the option has intrinsic value. In the case of a put, if the spot price is less than the option exercise price, the option has intrinsic value. Such options are said to bein-the-money'. If the opposite is true of either calls or puts, they have no intrinsic value and said to be out-of-the-money'.

28. What are the two kinds of value do currency options have?

29.When does a call option have intrinsic value?

30.What is the option said to be if it has intrinsic value?

(28)

A.Intrinsic value and time value.

B.Internal value and external value.

C.Exchange value and time value.

D.Real value and stated value.

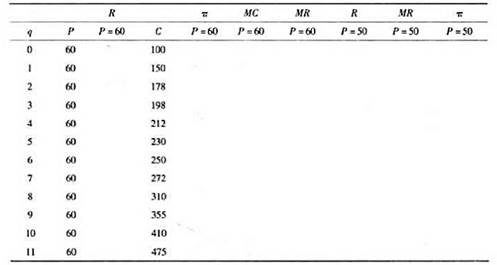

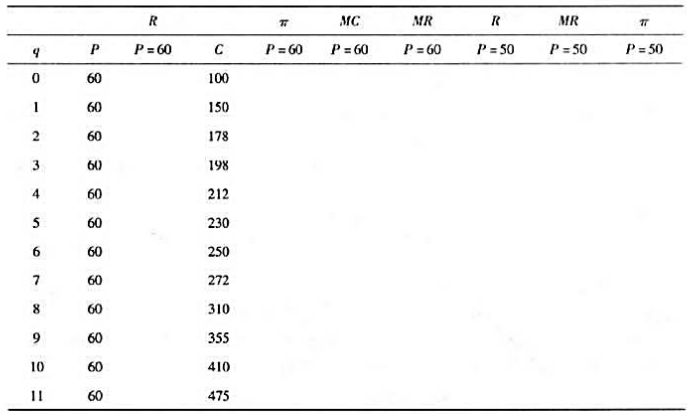

下表给出了一家厂商的单位产品销售价格(单位:美元)和总成本的信息,

(1)填充表中空格。

(2)如果价格从60美元下降到50美元,企业的产量选择和利润将如何变化?

The data in the following table give information about the price (in total ) for which a firm can sell a unit of output and the total cost of production.

a.Fill the blanks in the table.

b.Show what happens to the firm' s output choice and profit if the price of the product falls from$60 to $50.

Billions of dollars worth of new securities reach the market each year. The traditional (56) in the primary, markets is called an investment banker. The investment banker's principal activity is to bring sellers and buyers together, thus creating a market. He normally buys the new issue from the issuer at an agreed-upon price and hopes to (57) it to the investing public at a (58) price. In this capacity, investment bankers are said to underwrite, or guarantee, an issue. Usually, a group of investment bankers joins to underwrite a security offering and form. what is called an underwriting syndicate. The (59) received by the investment banker in this case is the differential, or spread, between his purchase and resale prices. The risk to the underwriter is that the issue may not attract buyers at a (60) differential.

(41)

A.buyer

B.organizer

C.seller

D.middleman

假设你在管理一座营运成本基本上为零的收费桥。过桥需求的Q由P=15-(1/2)Q给出。

(1)画出过桥服务的需求曲线。

(2)如果不收费,会有多少人通过该桥?

(3)如果过桥费是5美元,相对应的消费者剩余的损失是多少?

(4)该收费桥的运营方打算把价格上升至7美元。在这一相对较高的价格上,会有多少人通过该桥?该收费桥的收益是上升还是下降了?从你的答案出发,你对需求弹性有何判断?

(5)求与价格从5美元上升到7美元相对应的消费者剩余的损失。

Suppose you are in charge of a toll bridge that costs essentially nothing to operate. The demand for bridge crossing Q is given by P=15-(1/2)Q.

a. Draw the demand curve for bridge crossings.

b, How many people would cross the bridge if there were no toll?

C. What is the loss of consumer surplus associated with a bridge toll of $ 5?

d. The toll - bridge operator is considering an increase in the toll to $7. Al this higher price ,how many people would cross the bridge? Would the toll bridge revenue increase or decrease? What does your answer tell you about the elasticity of demand?

e. Find the lost consumer surplus associated with the increase in the price of the toll from $5to $7.